The Venture Capital Fundraising Landscape

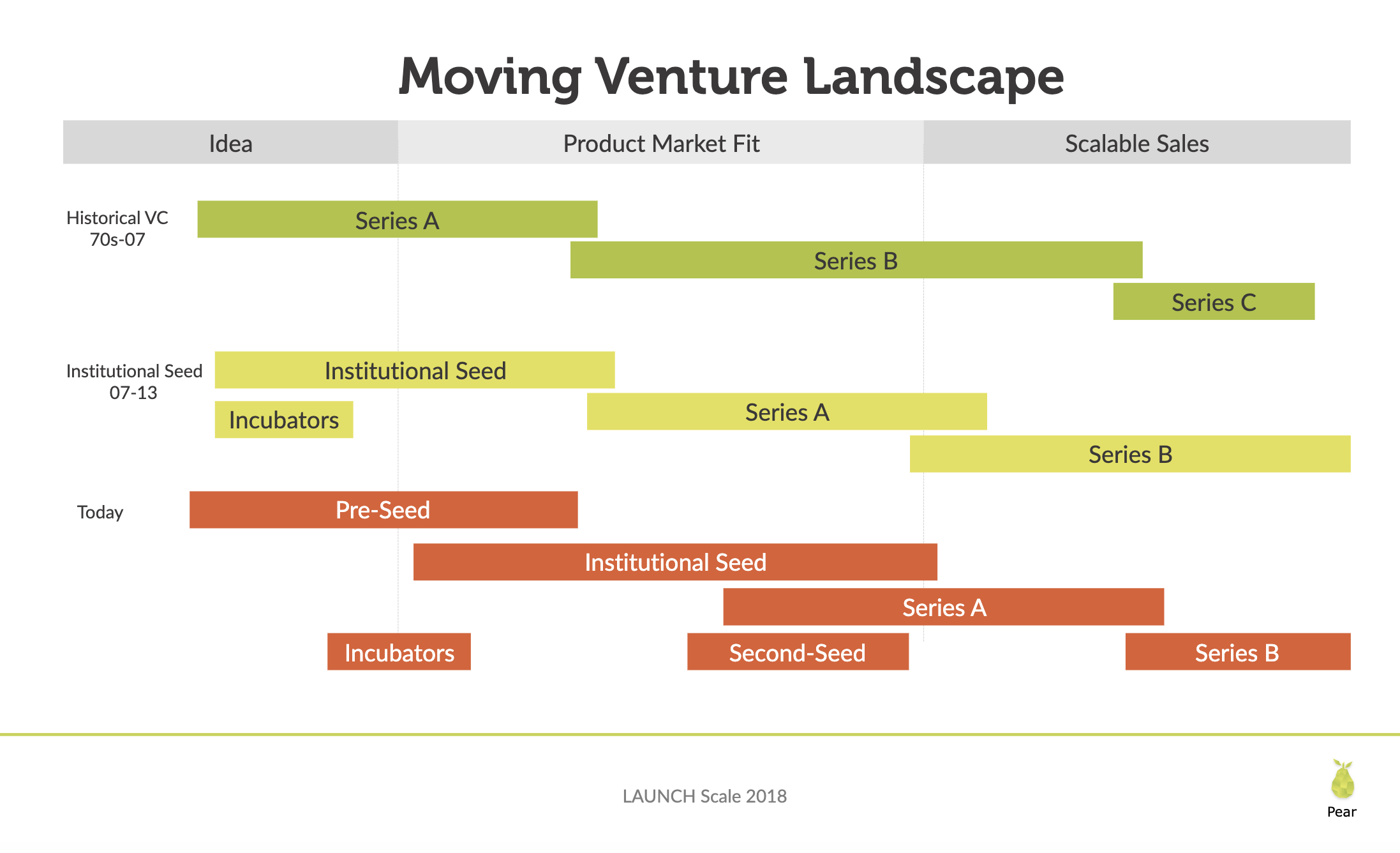

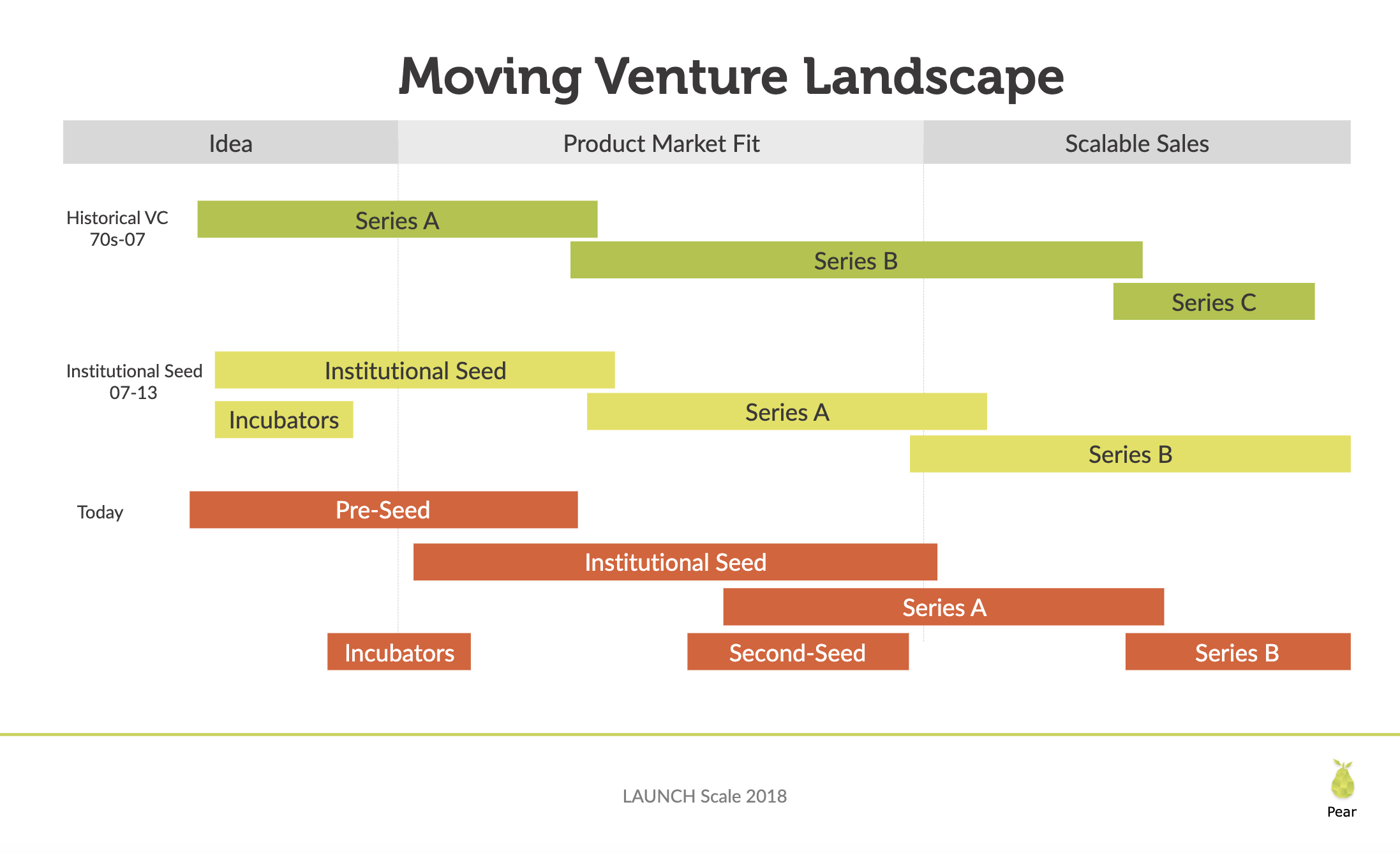

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing. The Venture Capital & Angel Investment landscape keeps moving upstream.

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing.

The Venture Capital & Angel Investment landscape keeps moving upstream. This is something that has caused serious confusion for founders in the last few years, with new names and terms being invented for those who enter the earlier stage of the market. While there were zero Seed Funds in 2003, there are now over eight hundred in 2019. And now we are seeing the rise of “Pre-Seed”, occurring as a new stage right before Seed.

Pear’s “Navigating The New Seed Landscape” presentation is packed with tons of insights around Venture Capital's Evolution. Check it out for yourself below.

Navigating The New Seed Landscape

If you are currently fundraising be sure to check out my new favorite software to automate the fundraising process! Feel free to reach out to me if you would like an invite for priority early access.

2016 Startup Funding Trends With Adeo Ressi

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Adeo Ressi at Valley in Berlin 2016

In 2015 it was all the rage to be a "unicorn", a startup company with a billion dollar valuation. Since then the supposed "startup and tech bubble" has popped and the gold rush is over. But what is really happening with the markets?

Alex Konrad recently gave us some insight on Ambition Today and now today we have a more in-depth explanation of what is happening from Adeo Ressi, the founder of the Founder Institute. Last month Adeo was in Germany for the "Valley in Berlin Summit" and keynoted a talk around the 2016 Startup Funding Trends we are currently seeing. If you are thinking about fundraising, have a startup, or plan on starting your own company you are going to want to watch the keynote below.

How Startup Funding Works

If you have ever wondered how startup funding works and what it would be like to go through this process of raising venture capital and angel investor money to fund your startup, well wonder no more

Venture Dealr

Most entrepreneur's are constantly looking to get their startup funded, starting from the very time of conception. The reality is that funding is just one part of a startup's life. Team, product, and execution are almost always more effective and powerful tools in a founder's arsenal than only throwing money at the problems your company working to solve.

Let's say though, that for the sake of this post, you got your company off the ground and funded. You even attracted enough investors to raise a Series A, B, and C too. Nice work! Then, some time after that you even exited your company as well! Impressive, I think you have the hang of this startup thing.

If you have ever wondered how startup funding works and what it would be like to go through the process of raising venture capital and angel investor money to fund your startup, well wonder no more. Dan Lopuch and the team at Data Hero have created the "Venture Dealr". A pretty sharp Github project that allows you to visualize and turn the knobs on venture financing concepts such as dilution, option pools, liquidation preferences, down-rounds, and more. So go ahead, take your startup and shoot for the moon by clicking the button below.

The Acceleration of Unicorn Startups

CB Insights just made this great infographic to help visualize the rate at which new billion dollar unicorn companies are being created. It seems to be as increasing trend since the start of 2014. There are now 142 total unicorn companies...

CB Insights just made this great infographic to help visualize the rate at which new billion dollar unicorn companies are being created. It seems to be as increasing trend since the start of 2014. There are now 142 total unicorn companies with a total cumulative valuation of $506B. This is up from 30 privately held technology companies worth more than $1B about 18 months ago.

Last month Mark Suster wrote on how he believes this trend is being driven by a fundamental change in the the structure of the Venture Capital industry and how money is entering the market. Let me know what you think is driving this change in the comments.

You can click to enlarge the infographic below.

Early Pitch Decks of Billion Dollar Unicorn Startups

Here are the early pitch decks of unicorn startups, those worth over a billion dollars. Check out the early pitch decks of Snapchat, AirBnB, Buzzfeed, Facebook, and Square.

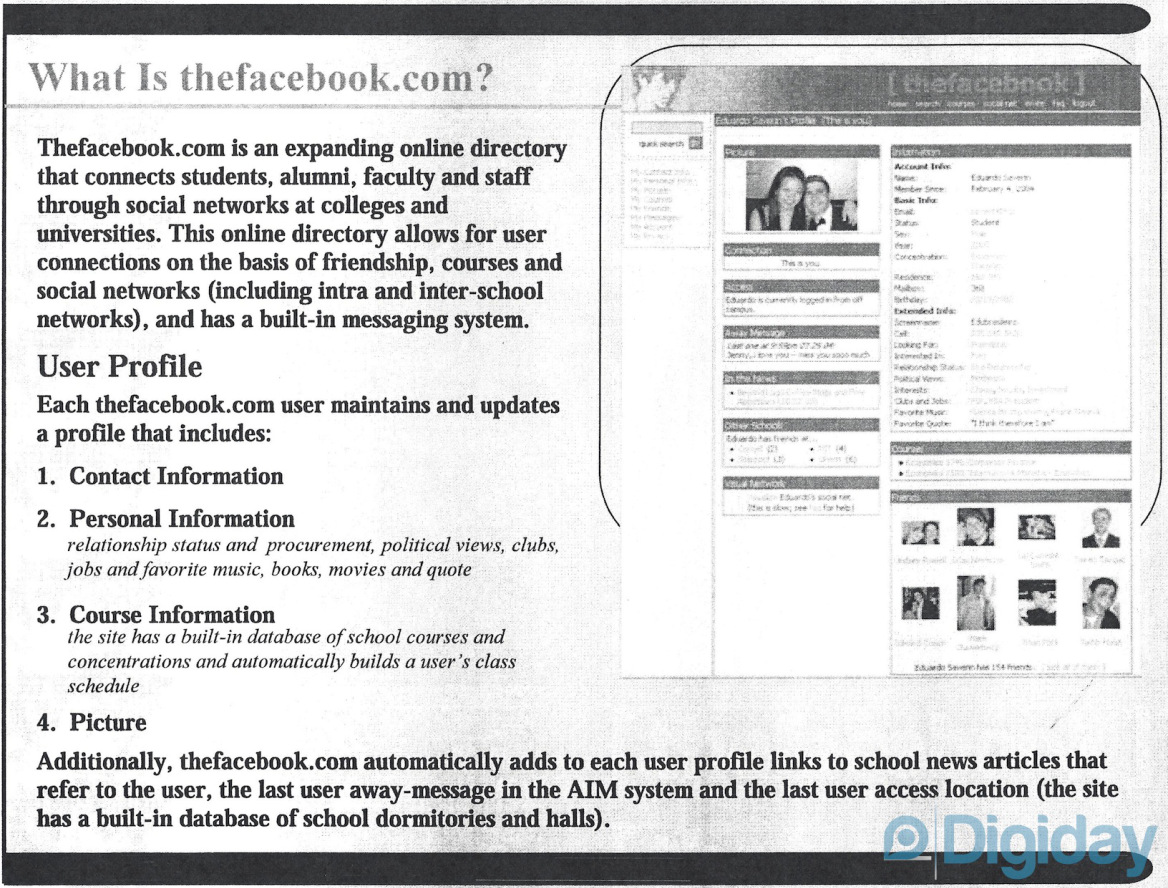

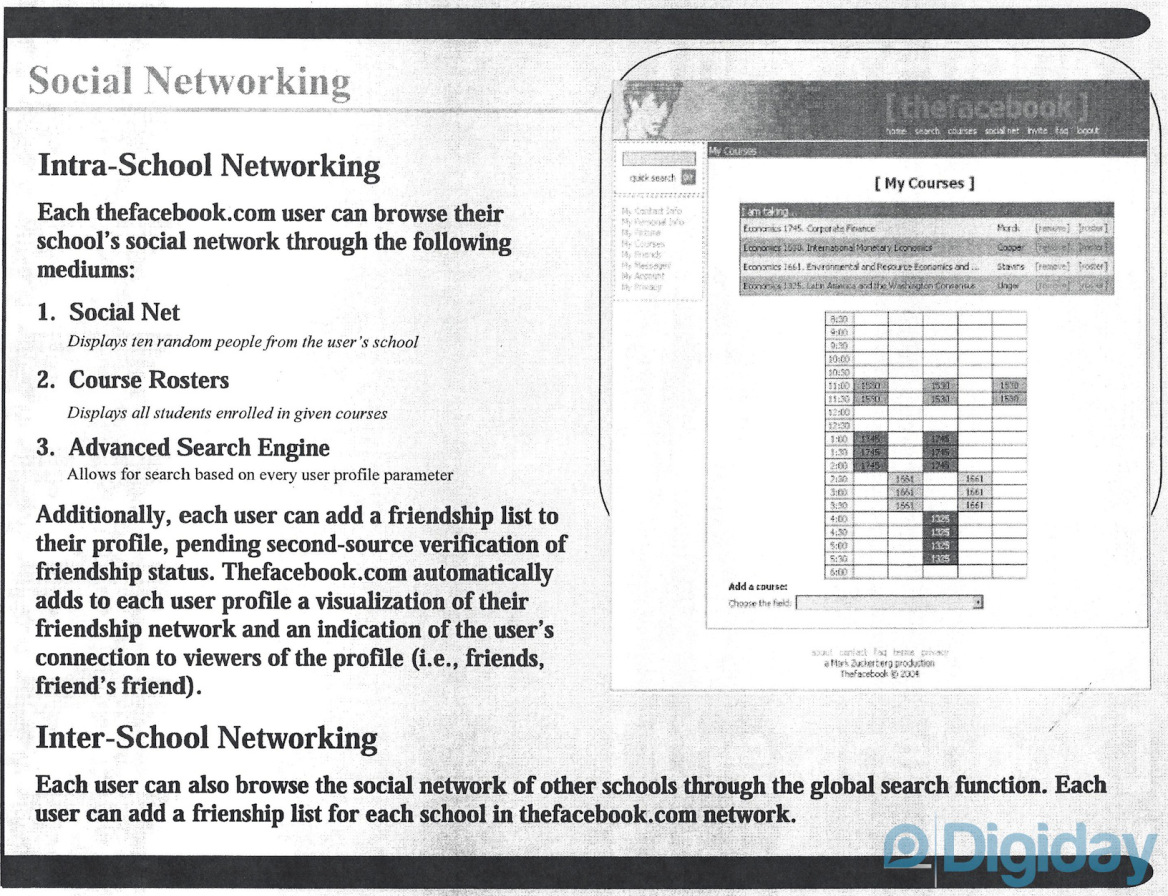

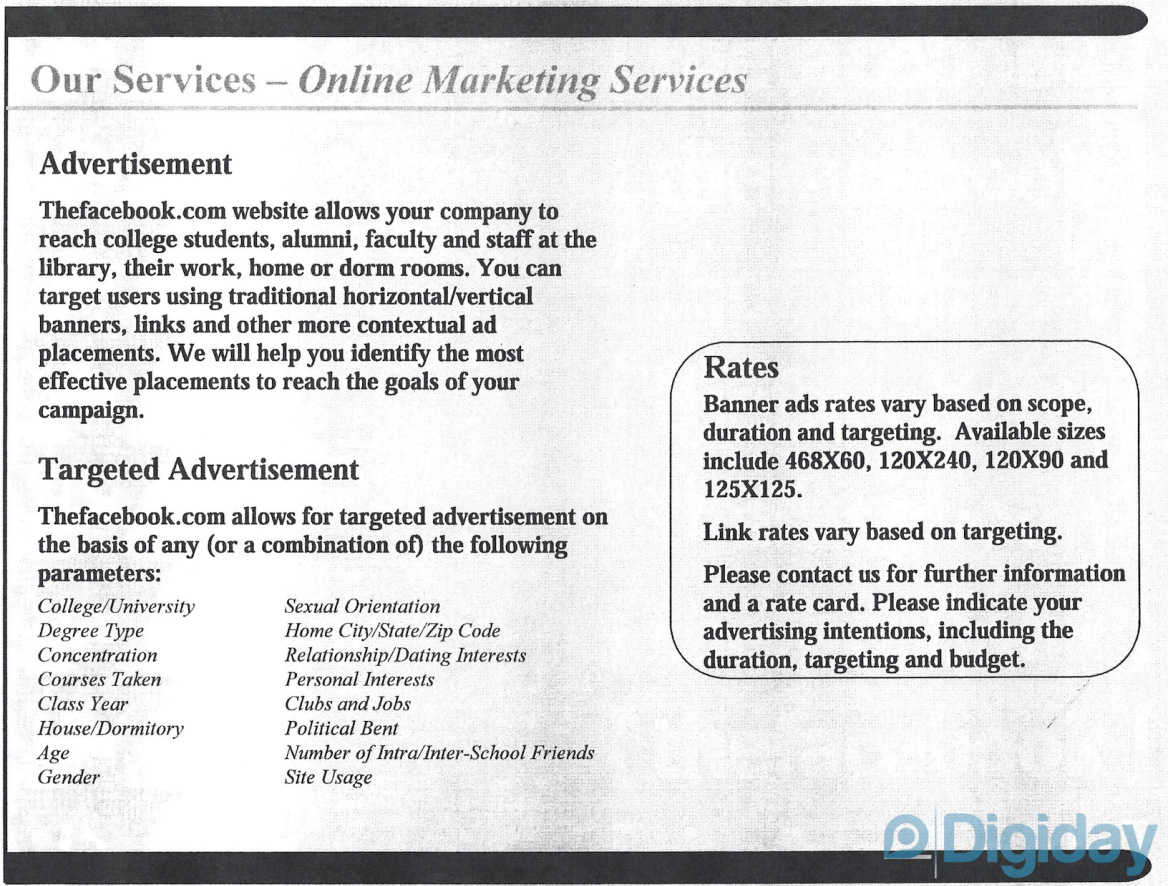

That photo app you were just using, the news feed your looking at, the website you just closed to book your vacation, all those companies had pitch decks long before most people ever heard of their name. Now those companies are worth billions of dollars. So what does early success look like? Here are the early pitch decks of some billion dollar startups, "unicorns"; Snapchat, AirBnB, Buzzfeed, Facebook, and Square

Snapchat - $16 Billlion Valuation

AirBnB - $25.5 Billion Valuation

Buzzfeed - $1.5 Billion Valuation

Facebook - $261 Billion Valuation