How Lorenzo Thione Is Scaling Support For Diverse Founders With Gaingels

Lorenzo Thione is the Managing Director of Gaingels, a leading LGBTQIA+/Allies investment syndicate and one of the largest and most active private investors in North America. He is also the co-founding Chairman of StartOut, Chairman of the Board at Social Edge, and previously co-founded Powerset, a natural-language search engine startup sold to Microsoft for $100 million in 2008.

We sat down with one of the most influential people in tech, Lorenzo Thione, who shares his very inspiring journey and how that led him to be where he is today.

Lorenzo grew up in Milan, Italy and had a technical background at an early age. He completed his studies at the University of Texas at Austin, from which he holds a M.S. in Computer Engineering.

He is now the Managing Director of Gaingels, a leading LGBTQIA+/Allies investment syndicate and one of the largest and most active private investors in North America. He is also the co-founding Chairman of StartOut, Chairman of the Board at Social Edge, and previously co-founded Powerset, a natural-language search engine startup sold to Microsoft for $100 million in 2008.

Lorenzo is named one of the most influential LGBT people in tech in 2014 and 2018 and his dedication in supporting and elevating leaders of the LGBTQ+ in the venture startup is amazing.

As the Managing Producer at Sing Out, Louis! Productions, he is also a Tony-Award winner (Hadestown, The Inheritance). He produced and co-created the Broadway musical, Allegiance starring George Takei and Lea Salonga. He is currently working in a new original musical, Indigo, as well as The Elephant Whisperer.

We covered a lot of ground in this episode, including:

Topics Discussed:

Where his passion comes from and how Lorenzo found entrepreneurship.

Helping others to build a diverse company by providing more than just funding.

The different companies that he had a part in building.

His mark on Broadway.

How your descent can make a difference in your future and your thinking.

How the model of angel groups is evolving to syndicates and SPV’s.

The role of a “Platform” strategy to help Gaingels portfolio companies.

What does Lorenzo think about the future of Venture Capital.

Quote of the Episode:

“Strategic Value, what is all being brought to the table”

The Greatest Piece of Advice:

His mentor told him to, “ be obsessive, about how you can add value, to your own network and relationships”

Links & show notes from this episode:

Ambition Today Is Proudly Independent & Supported By:

Finta - Finta’s end to end fundraising management platform enables you to manage your investors throughout their entire lifecycle in a single streamlined flow.

A-List: After every episode of the Ambition Today podcast we record an exclusive bonus clip, where we ask each guest to tell us the best advice they have ever received. Hear first-hand stories from over 30 entrepreneurs and investors in these exclusive bonus clips.

Listen to Ambition Today now:

Thank you for listening!

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going! 🤗

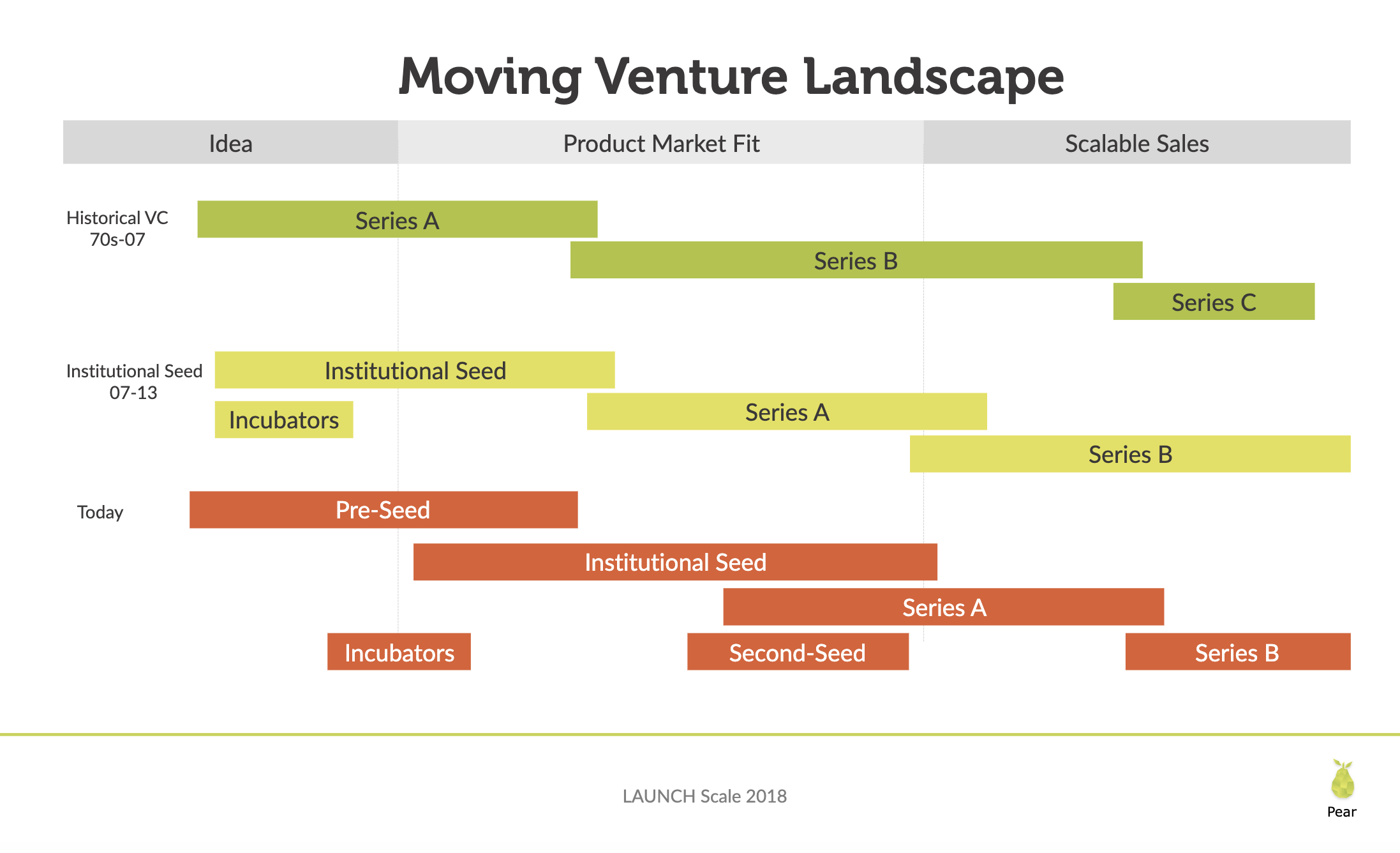

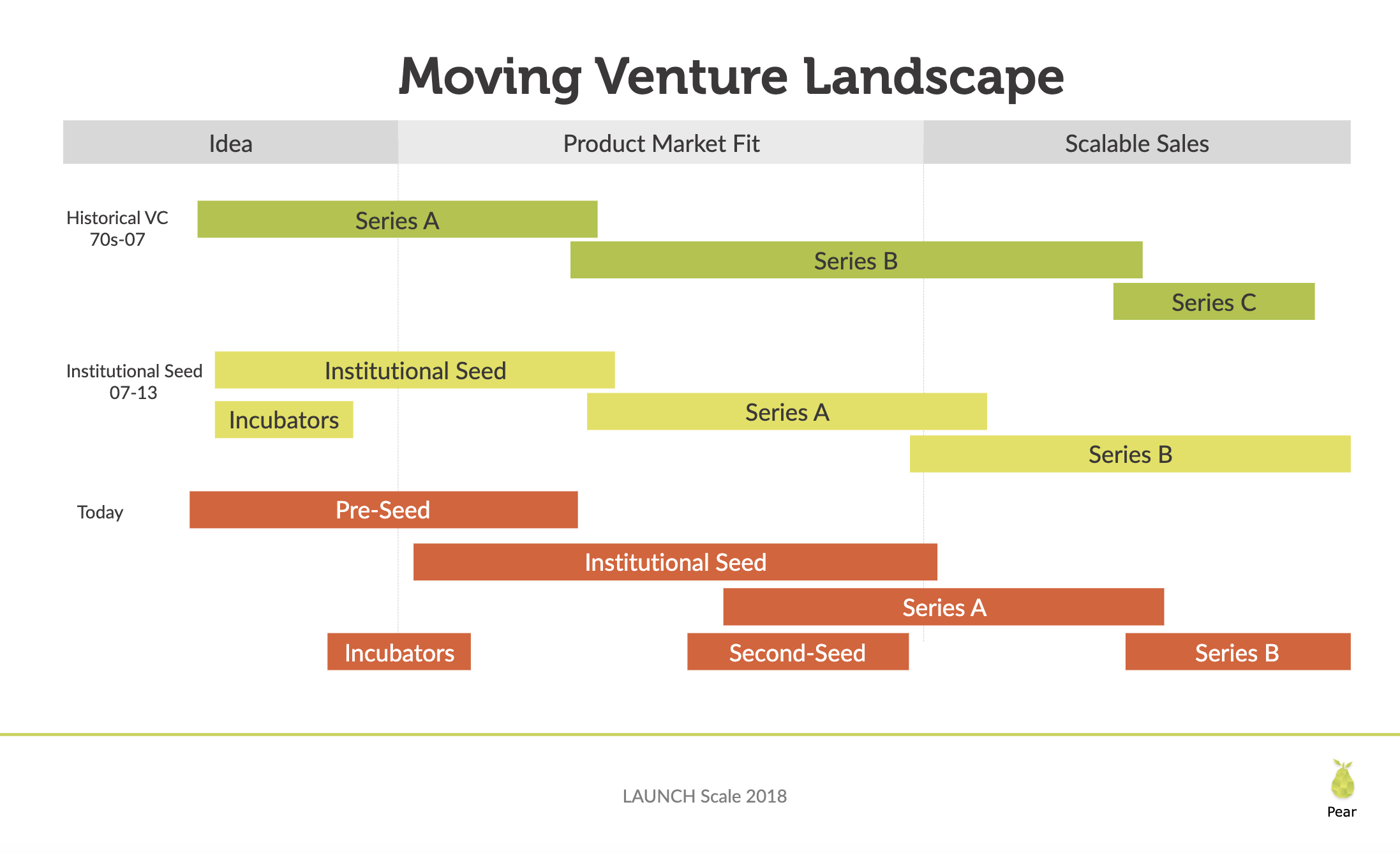

The Venture Capital Fundraising Landscape

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing. The Venture Capital & Angel Investment landscape keeps moving upstream.

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing.

The Venture Capital & Angel Investment landscape keeps moving upstream. This is something that has caused serious confusion for founders in the last few years, with new names and terms being invented for those who enter the earlier stage of the market. While there were zero Seed Funds in 2003, there are now over eight hundred in 2019. And now we are seeing the rise of “Pre-Seed”, occurring as a new stage right before Seed.

Pear’s “Navigating The New Seed Landscape” presentation is packed with tons of insights around Venture Capital's Evolution. Check it out for yourself below.

Navigating The New Seed Landscape

If you are currently fundraising be sure to check out my new favorite software to automate the fundraising process! Feel free to reach out to me if you would like an invite for priority early access.

How To Send Your Monthly Investor Updates

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master.

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master. Sending monthly investor updates is one of the best ways for a founder to maintain their existing connections and strengthen their new ones.

Long-term relationships are built with friends, family, and colleagues by staying close and in touch over long periods of time. It is so important that you still keep in contact with the people you want to stay close too, even when you think you don't have value to add or need something in the exact moment. One of Founder Institute New York’s mentors, Matt Rodak talked about the importance of sending monthly updates while building his startup company, Fund That Flip on an Ambition Today episode recently.

Benefits of Sending Investor Updates Frequently:

While this may seem overly simple at first glance, I assure you that many people take basic communication for granted and avoid the little bit of work it involves each month. For those that do send monthly updates, there are several non-obvious benefits aside from your company's business updates.

Being Top Of Mind:

Even if you don't get a response, it keeps you on top of people's mind. That next meeting your investor has, they might bring you up while you are fresh on their mind.

Creating Stronger Relationships:

Mark Suster has famously been quoted as saying people "Invest in Lines, Not Dots". Keeping in touch is how you build a long-term and enduring relationship. It's been that way since the caveman days and hasn't changed. It's human psychology.

Assuring Company & Personal Health:

Most of the time that investors don't hear from a founder they assume their startup company is dead or well on its way. Or worse, they just forget about you entirely. You just fade away from their memories, replaced by fresher memories of other startup founders. Before the internet, this was a given. In the world of social media though, we take this for granted as many feel that "online presence" is enough. I assure you, that unless you are Mark Cuban, it is not.

Gaining Insights & Reflection:

The process is insightful. Taking a moment to send someone an update on your life or business forces you to take a moment and reflect on the progress you have made in the last 30 days. In our busy lives, it is critical to make that time. As an additional bonus, you will be more productive and make better-informed decisions in the coming month as well.

Formatting:

So what should you include in your startup’s investor updates? You can find plenty of investor update examples and how-to articles that already exist when you google “Monthly Investor Updates." I am going to include links to many of my personal favorites below! There are many different styles of monthly investor updates, but most involve the same essentials.

Dear Kevin,

I hope you had an excellent August! For us it has been a mixed month, but we’re happy to report these developments.

Cash: Money in Bank and Monthly Expenses

Highlights:

KPIs:

Customers Update

Useful Graph, Image, or Screenshot

Employees/Team Changes

The Good:

The Bad:

Asks

Thank You's

Thank you,

Kyle

CEO, ACME Corporation

Monthly Investor Update Templates & Examples:

There are so many great investor update examples and investor update templates from some really amazing investors and founders: I collected some of the best investor update templates below for you:

A “Fill-In-The-Blank” Investor Update Template for Busy Founders - Micah Rosenbloom

13 Investor Update Emails That Turned Our Dots Into A Line - Reza Khadjavi

The Why and How Of Updating Your Angel Investors - Dharmesh Shah

What Should I Include In My Monthly Investment Update? - Jason Calacanis

So at the end of this month take even just one hour to send a monthly update. You should keep your update short and to the point. Think about what you have accomplished in the last month and what you need help achieving in the next month. Think about the people in your life that mentor and guide you. Hopefully, you already have them on a mailing list. And then send your update. You will be AMAZED at the compounding effects you will receive from putting monthly updates out there!

Lessons Howard Love Learned While Sitting On Both Sides Of The Table

Over the last 30 years Howard Love has founded 15 companies and invested in over 50 early stage startups. His new book "The Startup J Curve" organizes his experience into the 6 phases startups go through as they grow. Howard also is the Founder & CEO of LoveToKnow, a digital publishing firm with over 30 million monthly visitors.

HOWARD LOVE

Over the last 30 years Howard Love has founded 15 companies and invested in over 50 early stage startups. His new book "The Startup J Curve" organizes his experience into the 6 phases startups go through as they grow. Howard also is the Founder & CEO of LoveToKnow, a digital publishing firm with over 30 million monthly visitors.

With coal magnates and aviators as his ancestors, entrepreneurship has been in Howard's bloodline for generations. In this episode, Kevin speaks to Howard about what he has learned from sitting on both sides of the table, both as a founder and an investor. We also discuss the 6 phases all startups go through according to Howard's new book The Startup J Curve. We also hear about the value of getting a formal education versus learning directly from the real world and much more:

Growing up in a family that encourages and breeds entrepreneurial spirit.

Dropping out of college to get real world experience.

Being resourceful in the startup space.

The grit it takes to get your company off the ground.

The knowledge and insight gained from writing a book.

Advancing the dialogue of startup culture through understanding of the J-curve.

The phases of a company: create, release, morph, model, scale, and harvest.

Ambition Today Question of the Day™:

"When you think about the younger version of yourself, how do you reconcile where you are now, and where you thought you would be?"

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

David S. Rose Explains How The New Startup Crowdfunding Rules Affect You & His New Book The Startup Checklist

On this episode of Ambition Today David S. Rose explains his new book The Startup Checklist, how the new startup crowdfunding rules affect you & angel investing 101.

David Rose, The Startup Checklist

On this episode of Ambition Today David S. Rose explains his new book The Startup Checklist, how the new startup crowdfunding rules affect you & angel investing 101. A third generation serial entrepreneur, David's new book The Startup Checklist which is now a New York Times Bestseller. David is also the author of the Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups, as well as the Founder and CEO at Gust.

A man of many titles: Entrepreneur, Angel Investor, Mentor, and Author; David has had an incredible career starting several businesses. Crain's New York Business has called David "the father of angel investing in New York".

Today we learn about how he got started as a founder, became an angel investor, and where he is now as an Author and CEO. We cover the basics of how angel investing in startups works and unpack what the new SEC crowdfunding rules actually mean for startups, your friends, your family and you. We also learn about:

How an Urban Affairs degree enhanced David's views on business.

Why he started Angel Investing.

How NY Angels was created.

How do you set the foundation for a great startup company.

Angel Investing 101.

What is an Accredited Investor.

How Title 3 of the JOBS Act impacts startups and you.

What the new SEC crowdfunding rules mean if your income or net worth is below $100k.

What the new SEC crowdfunding rules mean if your income or net worth is above $100k.

If a founder decides to fundraise from non-accredited civilians, what do they need to know?

What platforms are enabling crowdfunding right now?

How can you invest in startups now.

Ambition Today Question of the Day™:

Why does success matter in the first place? Why not just live a simple life in a fishing town?

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

How Startup Funding Works

If you have ever wondered how startup funding works and what it would be like to go through this process of raising venture capital and angel investor money to fund your startup, well wonder no more

Venture Dealr

Most entrepreneur's are constantly looking to get their startup funded, starting from the very time of conception. The reality is that funding is just one part of a startup's life. Team, product, and execution are almost always more effective and powerful tools in a founder's arsenal than only throwing money at the problems your company working to solve.

Let's say though, that for the sake of this post, you got your company off the ground and funded. You even attracted enough investors to raise a Series A, B, and C too. Nice work! Then, some time after that you even exited your company as well! Impressive, I think you have the hang of this startup thing.

If you have ever wondered how startup funding works and what it would be like to go through the process of raising venture capital and angel investor money to fund your startup, well wonder no more. Dan Lopuch and the team at Data Hero have created the "Venture Dealr". A pretty sharp Github project that allows you to visualize and turn the knobs on venture financing concepts such as dilution, option pools, liquidation preferences, down-rounds, and more. So go ahead, take your startup and shoot for the moon by clicking the button below.