Fundraising In 2024 - Three Sides Of The Table

During NY Tech Week 2024 Finta hosted a live panel discussion in midtown Manhattan on the state of fundraising in 2024. Delving deep into the nuances of fundraising from three different perspectives: an investor, a founder, and a lawyer.

Our incredible panel for this event consists of:

The Founder

David Silverstein, is the CEO of Ned, a white label lending platform that makes it easy for lenders to effortlessly deploy capital.

The Investor

Rachel ten Brink, General Partner at Red Bike Capital, an early-stage VC fund based in New York, specializing in SaaS, Health & Wellness, and Fintech sectors in the U.S. With over 30 years of experience, including founding a Y Combinator-backed startup that reached $100M in revenue and managing $2B in assets.

The Lawyer

Jack Sousa, is the Partner & Co-Chair of the Emerging Companies and Venture Capital Practice Group at Wiggin. He is also a wiggin(x) Co-Founder and Partner. Jack focuses his practice on venture capital, startup and early-stage companies and their financing needs.

Take A Listen To The Event:

Key Fundraising Insights From This Episode:

How Should Founders Think About Fundraising

David Silverstein kicked off the event emphasizes the importance of focus during a raise. Trying to shrink the amount of time you spend fundraising so you can get back to building the business. Highlighting the importance of relationship building in fundraising, while de-risking and hitting the right milestones to build trust with investors.

Rachel ten Brink advises founders to start planning their next round of funding as soon as they close their current round. She emphasizes the need to reverse-engineer the process, understanding how far the current funds will take the company and what metrics need to be hit for the next raise.

AI's Influence On Startups

AI will fundamentally transform the venture capital landscape. Rachel notes that AI is not just a sector but a foundational technology that will touch every industry. David adds that while AI is important, it is crucial to solve fundamental business problems first.

VC Investor Relations with LP's

Rachel discusses the current trends in VC strategies and the importance of understanding the dynamics between VC funds and their LPs. She highlights the necessity for founders to be aware of the financial health and commitments of the VCs they are pitching to.

Current Market Trends and Company Valuations

The discussion centers around the importance of always being prepared to fundraise and understanding market dynamics. David stresses the situational nature of fundraising, advising founders to be ready to adapt to market conditions.

Important Fundraising Legal Considerations

Jack Sousa recommends involving a lawyer early in the fundraising process to navigate complex legal terms and agreements. He mentions the return of redemption provisions and full ratchet anti-dilution clauses as trends to watch.

How Can Founder's Stand Out To Investors

To stand out, David suggests focusing on demonstrating real customer traction and needs. Rachel emphasizes the importance of clear, concise pitch decks and consistent communication with investors.

Strong Investor Communication

Balancing warm introductions and cold outreach is crucial. David recommends building relationships with investors before needing to raise funds, while Rachel highlights the importance of thoughtful signaling and avoiding desperate outreach.

Practical Tips for Founders

Jack Sousa and Rachel discuss essential legal terms, noting the increasing prevalence of liquidation preferences and full ratchet anti-dilution clauses. They advise founders to keep their cap tables clean and to be aware of the long-term implications of their fundraising choices.

Industry-Specific Insights

Raising funds for deep tech ventures involves unique challenges compared to traditional SaaS startups. Rachel and David emphasize the importance of understanding sector-specific milestones and investor expectations.

The End of Software...?

The panel debates whether the software market has matured. Rachel argues that while the market is evolving, there is still significant upside potential for innovative software solutions, particularly those integrating AI.

Hosting this event was a blast! A massive thank you to everyone who helped make this event happen and a success. We can't wait to see you all at the next one!

Millennial Investing Podcast Episode: Venture Capital Investing With Kevin Siskar

Last month I had the opportunity to sit on the opposite sit of the podcaster’s table to be a guest on the Millennial Investing Podcast! Where hosts, Robert Leonard and Clay Finck interview successful entrepreneurs, business leaders, and investors to help educate and inspire the millennial generation.

Recently, I had the opportunity to sit on the opposite sit of the podcaster’s table to be a guest on the Millennial Investing Podcast! Where hosts, Robert Leonard and Clay Finck interview successful entrepreneurs, business leaders, and investors to help educate and inspire the millennial generation.

I hope you enjoy the episode. Listen here!

Host Clay Finck chats with Kevin Siskar about venture capital investing, the types of companies emerging in the venture capital space, how studying human behavior can help you as an investor, the differences between working at a large corporation vs a smaller company, how you can shift yourself to have a growth mindset, how luck has played into the companies Kevin has worked with, and much, much more!

Topics Discussed:

· What types of companies 43North looks to invest in.

· Why tech incubators should be everywhere, not just in Silicon Valley.

· What types of industries are currently most exciting from Kevin’s point of view.

· How studying human behavior can help you as an investor.

· What Kevin wishes he could tell his younger self about investing in startups.

· The differences between working at a large corporation and working at a smaller company.

· How people can shift from a worker mindset to a growth mindset.

· How luck has played into the companies that Kevin has worked with.

· The importance of a strong network and how Kevin maintains such a wide network.

· And much, much more!

43North's $1 Million Investment Opportunity

Now in its seventh year, the competition offers eight new startups a chance to secure up to $1 million in funding and land a spot in 43North’s next cohort. I have joined the team to help select this year’s companies, and we are currently accepting startup applications for $500k to $1m in investment until July 19th! Investing in founders with deep domain expertise and early traction for their high-growth startup!

Being born and raised in Buffalo, NY, I have always loved my hometown city. If you are curious about why, I recommend you check out “The Incredible History of Buffalo, NY In 5 Minutes”, which I shared in the Huffington Post a few years ago.

Scott Wayman of Kangarootime, after winning 43North in 2017

In 2014, Buffalo started 43North, investing $5M per year to attract and retain high-growth companies in Buffalo, NY. Fast forward to 2017, and after meeting Scott Wayman, the founder of Kangarootime, at a Founder Institute event in Silicon Valley, I recommended the company to 43North. Kangarootime ran with it and crushed it. First, securing an initial $500k investment from 43North, and then subsequently more follow on funding. They have since grown a significant presence in Western New York and continuing to build a great company!

Then in 2018, one of my Founder Institute New York portfolio companies, Teddy Mozart, received a large purchase order from QVC. A massive break, but they needed help financing the inventory to fill the QVC order. Carlton, the founder, told me he found Kickfurther, which secures inventory funding via their marketplace of investors. Through Kickfurther, Teddy Mozart managed to get the funds needed to fill the QVC order in less than 72 hours! I told this story while helping to deliberate the final investment decision in 2018, and I like to think it helped play a role in Kickfurther joining the 43N portfolio that year!

Now in its seventh year, the competition offers eight new startups a chance to secure up to $1 million in funding and land a spot in 43North’s next cohort. I have joined the team to help select this year’s companies, and we are currently accepting startup applications for $500k to $1m in investment until July 19th! Investing in founders with deep domain expertise and early traction for their high-growth startup!

If you or someone you know might be a good fit, visit 43 North to apply, or feel free to text me at +1 (646) 907-6669 if you would like to connect directly about the opportunity!

The Venture Capital Fundraising Landscape

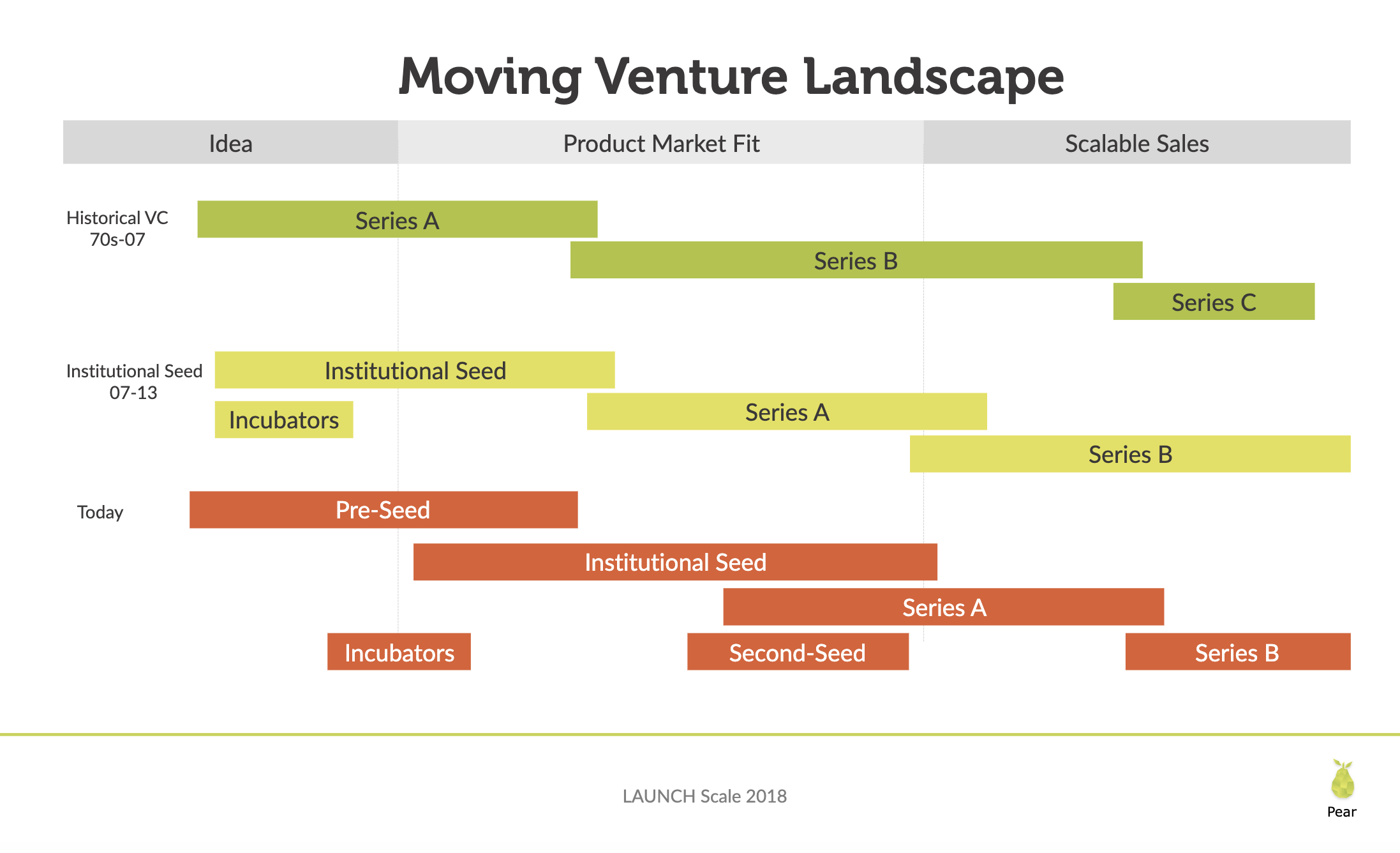

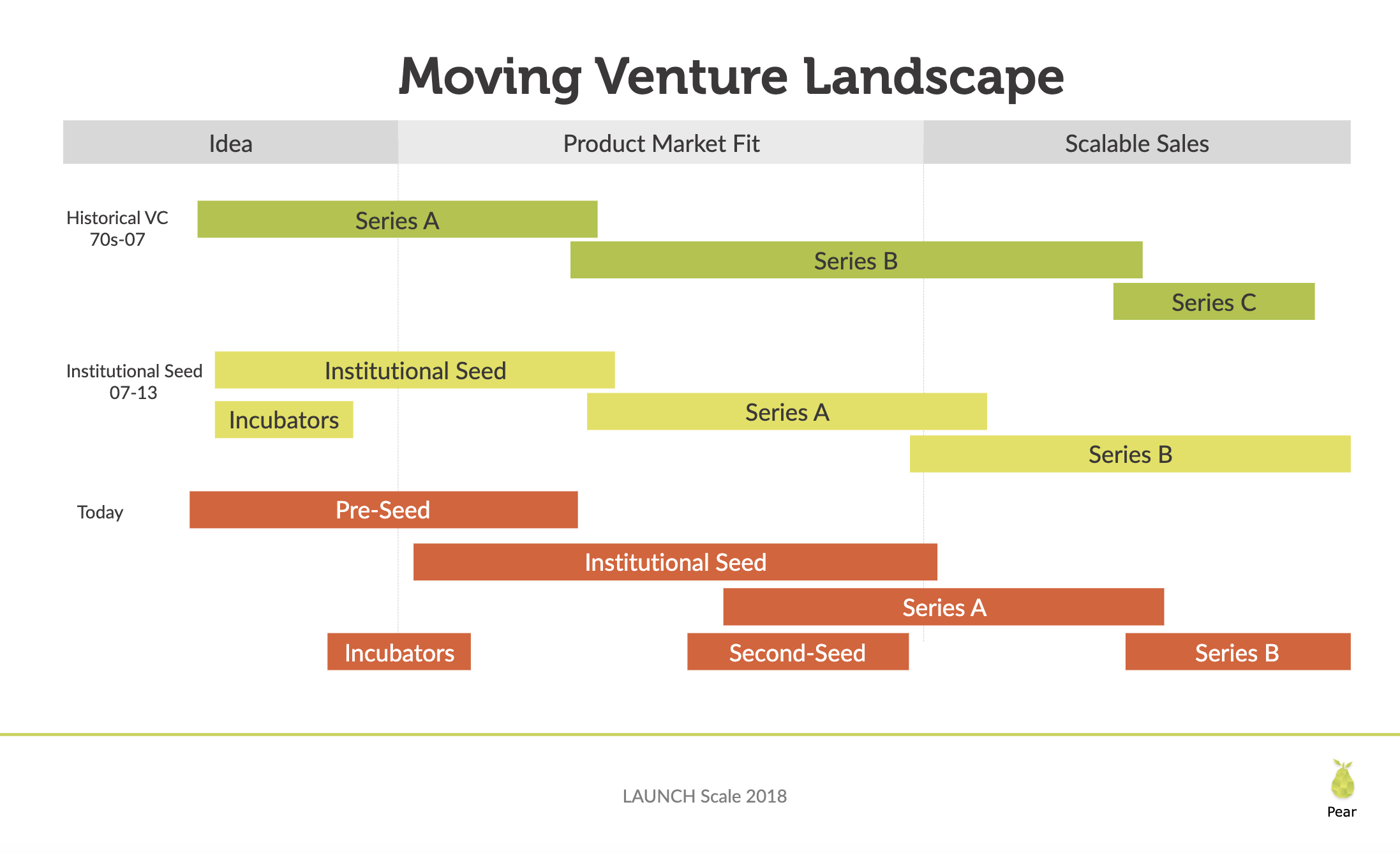

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing. The Venture Capital & Angel Investment landscape keeps moving upstream.

As we close out one decade and enter another it is worth reflecting on what has changed in the last ten plus years of the Venture Capital industry. Pear.Vc recently published a wonderfully insightful deck, the Seed Financing Landscape, on just that and I thought it was worth sharing.

The Venture Capital & Angel Investment landscape keeps moving upstream. This is something that has caused serious confusion for founders in the last few years, with new names and terms being invented for those who enter the earlier stage of the market. While there were zero Seed Funds in 2003, there are now over eight hundred in 2019. And now we are seeing the rise of “Pre-Seed”, occurring as a new stage right before Seed.

Pear’s “Navigating The New Seed Landscape” presentation is packed with tons of insights around Venture Capital's Evolution. Check it out for yourself below.

Navigating The New Seed Landscape

If you are currently fundraising be sure to check out my new favorite software to automate the fundraising process! Feel free to reach out to me if you would like an invite for priority early access.

How To Send Your Monthly Investor Updates

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master.

The single most powerful tool we have as humans is the ability to communicate. So it makes sense that this is one of the skillsets that all great founders need to master. Sending monthly investor updates is one of the best ways for a founder to maintain their existing connections and strengthen their new ones.

Long-term relationships are built with friends, family, and colleagues by staying close and in touch over long periods of time. It is so important that you still keep in contact with the people you want to stay close too, even when you think you don't have value to add or need something in the exact moment. One of Founder Institute New York’s mentors, Matt Rodak talked about the importance of sending monthly updates while building his startup company, Fund That Flip on an Ambition Today episode recently.

Benefits of Sending Investor Updates Frequently:

While this may seem overly simple at first glance, I assure you that many people take basic communication for granted and avoid the little bit of work it involves each month. For those that do send monthly updates, there are several non-obvious benefits aside from your company's business updates.

Being Top Of Mind:

Even if you don't get a response, it keeps you on top of people's mind. That next meeting your investor has, they might bring you up while you are fresh on their mind.

Creating Stronger Relationships:

Mark Suster has famously been quoted as saying people "Invest in Lines, Not Dots". Keeping in touch is how you build a long-term and enduring relationship. It's been that way since the caveman days and hasn't changed. It's human psychology.

Assuring Company & Personal Health:

Most of the time that investors don't hear from a founder they assume their startup company is dead or well on its way. Or worse, they just forget about you entirely. You just fade away from their memories, replaced by fresher memories of other startup founders. Before the internet, this was a given. In the world of social media though, we take this for granted as many feel that "online presence" is enough. I assure you, that unless you are Mark Cuban, it is not.

Gaining Insights & Reflection:

The process is insightful. Taking a moment to send someone an update on your life or business forces you to take a moment and reflect on the progress you have made in the last 30 days. In our busy lives, it is critical to make that time. As an additional bonus, you will be more productive and make better-informed decisions in the coming month as well.

Formatting:

So what should you include in your startup’s investor updates? You can find plenty of investor update examples and how-to articles that already exist when you google “Monthly Investor Updates." I am going to include links to many of my personal favorites below! There are many different styles of monthly investor updates, but most involve the same essentials.

Dear Kevin,

I hope you had an excellent August! For us it has been a mixed month, but we’re happy to report these developments.

Cash: Money in Bank and Monthly Expenses

Highlights:

KPIs:

Customers Update

Useful Graph, Image, or Screenshot

Employees/Team Changes

The Good:

The Bad:

Asks

Thank You's

Thank you,

Kyle

CEO, ACME Corporation

Monthly Investor Update Templates & Examples:

There are so many great investor update examples and investor update templates from some really amazing investors and founders: I collected some of the best investor update templates below for you:

A “Fill-In-The-Blank” Investor Update Template for Busy Founders - Micah Rosenbloom

13 Investor Update Emails That Turned Our Dots Into A Line - Reza Khadjavi

The Why and How Of Updating Your Angel Investors - Dharmesh Shah

What Should I Include In My Monthly Investment Update? - Jason Calacanis

So at the end of this month take even just one hour to send a monthly update. You should keep your update short and to the point. Think about what you have accomplished in the last month and what you need help achieving in the next month. Think about the people in your life that mentor and guide you. Hopefully, you already have them on a mailing list. And then send your update. You will be AMAZED at the compounding effects you will receive from putting monthly updates out there!

From Israel to Silicon Valley, Niv Dror's Journey To Conquer Social Media

Season Two of Ambition Today is happy to welcome Niv Dror, head of social media for Product Hunt. Niv boasts in impressive resume in both startups and finance, stemming from his education at UC Santa Barbara.

Niv Dror, Shrug Capital

Season Two of Ambition Today is happy to welcome Niv Dror, head of social media for Product Hunt. Niv boasts an impressive resume in both startups and finance, stemming from his education at UC Santa Barbara. After moving to Silicon Valley at a very young age, Niv had surprisingly little involvement in the tech world. It surrounded him entirely and thus he never noticed it, as water to a fish. However, after auditing a few hedge funds and VC funds as a CPA, he knew where his skills truly belonged.

Niv Dror’s taste of the tech community flourished very quickly, landing non-engineering jobs at DataFox, Meerkat, and Product Hunt. He aspired to add value without asking anything in return, and was rewarded with the experience and skills to climb the ranks at multiple organizations, currently aiding the curation of the world's most cutting-edge technology on Product Hunt. Kevin and Niv explore what's behind this drive, the man he gives credit to involuntarily kickstarting his success, and much more:

Growing up in Israel and moving to the U.S. at a young age.

Pursuing a finance degree and applying it to the startup world.

Getting exposure to the tech industry by auditing a successful VC.

Building an engaging community around a product.

What changes we can see in social in 2017.

The war of pronunciation for “gif”.

We why all love gifs and how Twitter is the perfect platform.

Ambition Today Question of the Day™:

"Should people optimize for learning or for earning?"

Quote Of The Episode:

"Community is everything. Without the community, Product Hunt wouldn't work."

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Jesse Middleton Talks Building WeWork Labs And Investing With Flybridge Capital

Over the years WeWork has grown to become an $16 billion empire of co-working office spaces that are disrupting the traditional real estate markets all over the world. Our guest today, Jesse Middleton, joined the team as the founder of WeWork Labs, the company’s startup focused community. Since then he has helped the company grow into the giant it is today. Recently he has just joined the venture capital firm Flybridge as a General Partner.

Jesse Middleton

Over the years WeWork has grown to become a $16 billion empire of co-working office spaces that are disrupting the traditional real estate markets all over the world. Our guest today, Jesse Middleton, joined the team as the founder of WeWork Labs, the company’s startup focused community. Since then he has helped the company grow into the giant it is today. Recently he has just joined the venture capital firm Flybridge as a General Partner.

Early on with entrepreneurial parents, Jesse learned that he did not have to take the traditional path in life and that he could forge his own future. He started to do just that, as he founded his first company before even going to college. Fast forward to Fast Company magazine once comparing Jesse to Jack Dorsey, then onto his time building WeWork Labs, and now his time as a VC at Flybridge. Jesse has a great story full of many lessons, such as:

Recognizing at an early age the ability to create your own path in life.

The importance of keeping a clear focus at the early stages of a new company.

How Jesse founded WeWork Labs.

Just get started and go.

The lessons from actively helping grow a $16 billion company.

Why long term vision is so important for the founders of companies.

What is next for WeWork Labs.

The intersection of community building and being an investor.

The future of Venture Capital.

Ambition Today Question of the Day™:

“What does Ambition mean to you and how has it driven you?”

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS, on Google Play Music or Stitcher for Android.

Listen to this episode now:

Ambition Today Episode Sponsors:

Toptal

Audible.com

Founder Institute New York

Ambition Today: Adam Besvinick Teaches The Art of Hustle and How To Break Into Your Dream Role

Venture Capitalist Adam Besvinick explains the value of pure hustle in pursuing his dreams of breaking into the Startup and Venture Capital industry. Recently named to the Forbes 30 Under 30, Adam has invested in several startup companies as Principal at Deep Fork Capital.

Adam Besvinick, Principal VENTURE CAPITALIST aT Deep Fork Capital

Venture Capitalist Adam Besvinick explains the value of pure hustle in pursuing his dreams of breaking into the Startup and Venture Capital industry. Recently named to the Forbes 30 Under 30, Adam has invested in several startup companies as Principal at Deep Fork Capital.

In episode 14 we explore where Adam came from and how that connects to where he is now. Adam started blogging on VentureMinded.Me years ago and created his own track record through taking ownership of his brand. He has always strived to be continually helpful and add value to others. Through that hustle he previously worked his way into a role at Lowercase Capital to learn from Chris Sacca. Afterword Adam was one of the early employees at Gumroad while going to Harvard Business School. Now Adam is Principal at Deep Fork Capital and has invested in several companies across the country, with a focus on New York City and Silicon Valley. We go over what he looks for in great startups, how he used self-marketing to break into venture capital, and also cover:

The influences of growing up around entrepreneurship.

The value of experiencing life abroad.

How to demonstrate your expertise in a given field.

Why self-marketing is important.

How Twitter can create real world connections.

How constantly being helpful to others, leads to opportunity.

His experience at Duke and Harvard.

The differences between Silicon Valley and New York City.

How being an Investor in New York City is beneficial.

What Adam looks for in startups today.

Exploring some of the Deep Fork Capital portfolio companies.

Ambition Today Question of the Day:

How important is networking?

Links from this episode:

Thank you so much for listening and applying these useful tips and strategies to your life! If you have a chance, please drop by and leave a review for the show on iTunes by clicking here. Also, who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

Founder Institute New York

Ambition Today: Alex Konrad of Forbes on Harvard, Media, and Startup Venture Capital

Episode 13 comes to you from New York Offices of Forbes as we are joined by Alex Konrad. Alex is a staff writer at Forbes covering venture capital, startups and enterprise tech.

Episode 13 comes to you from New York Offices of Forbes as we are joined by Alex Konrad. Alex is a staff writer at Forbes covering venture capital, startups and enterprise tech.

Aside from our discussion around Kanye West's recent discovery of Twitter we explore Alex's journey to now. Alex grew up in New York City, then went on to write at the Harvard Crimson before working at Fortune. Alex now is a staff writer at Forbes and also works on the Forbes Midas List, ranking the top Venture Capitalists of the past year, and the Forbes 30 Under 30, highlighting up and coming creative and business people. Today we talk about Harvard, the future of media, startups and venture capital. We cover a lot in this episode. including:

Getting into Harvard.

Working for the Harvard Crimson news and editorial board.

Why empathy matters so much in today's world.

How Alex got his start at Fortune working on the Fortune 500.

The relationship between print and digital articles in 2016.

When to go outside your "swim lane".

How to become a real New Yorker?

The advantages of the New York Tech Scene.

Writing the Forbes Midas List and Forbes 30 Under 30.

How large tech companies grow global startup ecosystems.

What global cities are up and coming for startups.

Why are the Venture Capital markets slowing down.

The best way to get media attention for your brand.

Ambition Today Question of the Day:

How important is self marketing?

Links from this episode:

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

Ambition Today: Jeff Wald, Co-founder of Work Market, talks Harvard, NYPD, Venture Capital, Startups, and Mentoring

On episode eight Jeff Wald, Co-founder and President of Work Market and his incredibly charitable no shave Movember mustache join Ambition Today. "The only thing I know with 100% certainty is that it ain't going down like this." - Jeff Wald

Jeff Wald, Work Market

On episode eight Jeff Wald, Co-founder and President of Work Market join's Ambition Today.

"The only thing I know with 100% certainty is that it ain't going down like this." - Jeff Wald

Jeff Wald’s background is nothing short of impressive. He started at Cornell University and then went to J.P. Morgan. He then went back to school at Harvard for an MBA. After Harvard Jeff spent time at Glen Rock Group before going on to Co-found Spin Back. The wild ride of Spinback, his first startup, took Jeff to almost moving back home after coming close to running out of money. The answer was to rebuild the business which later ended up getting acquired. After acquisition Jeff went to Barington Capital Group, and finally to his current company where he is the Co-founder and President of Work Market. Did I mention he was also an auxiliary member of the NYPD as well? This is an episode packed full of insights:

Is getting a Master's of Business Administration worth the return on investment?

Should you start a company or get an MBA?

The value of spending time with Entrepreneurs.

How to break into Venture Capital.

Leaving a job in Venture Capital to start a new company.

How to attract high quality investors in your startups such as Fred Wilson from Union Square Ventures, Spark Capital, and Softbank.

The one question you should start every meeting with.

The four different types of conversations.

Differences between Advisors and Mentors.

The importance of giving back to others

The Ambition Today Question of the Day:

Who would win in a fight, Batman vs Superman?

Be sure to listen and subscribe to Ambition Today in the iTunes Store for iOS and on Stitcher for Android.

Links from this episode:

Work Market, Acquired by ADP

@JeffreyWald on Twitter

Why I Mentor by Jeff Wald in the Huffington Post

NYPD Blue -- What I Learned About Startups Patrolling the Streets of New York City by Jeff Wald in the Huffington Post

NYPD Auxiliary Officer program

Who should I interview next? Please let me know on Twitter or in the comments. Do you enjoy this podcast? If so, please leave a short review in the comments below. It keeps me going…

Listen to this episode now:

Ambition Today Podcast Sponsors:

Audible.com

How Startup Funding Works

If you have ever wondered how startup funding works and what it would be like to go through this process of raising venture capital and angel investor money to fund your startup, well wonder no more

Venture Dealr

Most entrepreneur's are constantly looking to get their startup funded, starting from the very time of conception. The reality is that funding is just one part of a startup's life. Team, product, and execution are almost always more effective and powerful tools in a founder's arsenal than only throwing money at the problems your company working to solve.

Let's say though, that for the sake of this post, you got your company off the ground and funded. You even attracted enough investors to raise a Series A, B, and C too. Nice work! Then, some time after that you even exited your company as well! Impressive, I think you have the hang of this startup thing.

If you have ever wondered how startup funding works and what it would be like to go through the process of raising venture capital and angel investor money to fund your startup, well wonder no more. Dan Lopuch and the team at Data Hero have created the "Venture Dealr". A pretty sharp Github project that allows you to visualize and turn the knobs on venture financing concepts such as dilution, option pools, liquidation preferences, down-rounds, and more. So go ahead, take your startup and shoot for the moon by clicking the button below.